Trump's Binance Gambit: A Pardon That Rewrites Crypto's Rules and Signals a New Era of Political Finance

"In a move that sends shockwaves through the financial world, former President Donald Trump has pardoned Changpeng Zhao, the embattled founder of Binance. This unprecedented action, steeped in legal and political complexities, not only frees Zhao but also throws the future of cryptocurrency regulation and the very definition of political influence into question. The ramifications will reshape the global financial landscape for years to come."

Key Takeaways

- •Trump's pardon of CZ signals a pro-crypto stance and potential regulatory shifts.

- •The move could unlock a flood of investment and reshape the financial landscape.

- •This sets the stage for a period of volatility and regulatory chaos within the crypto market.

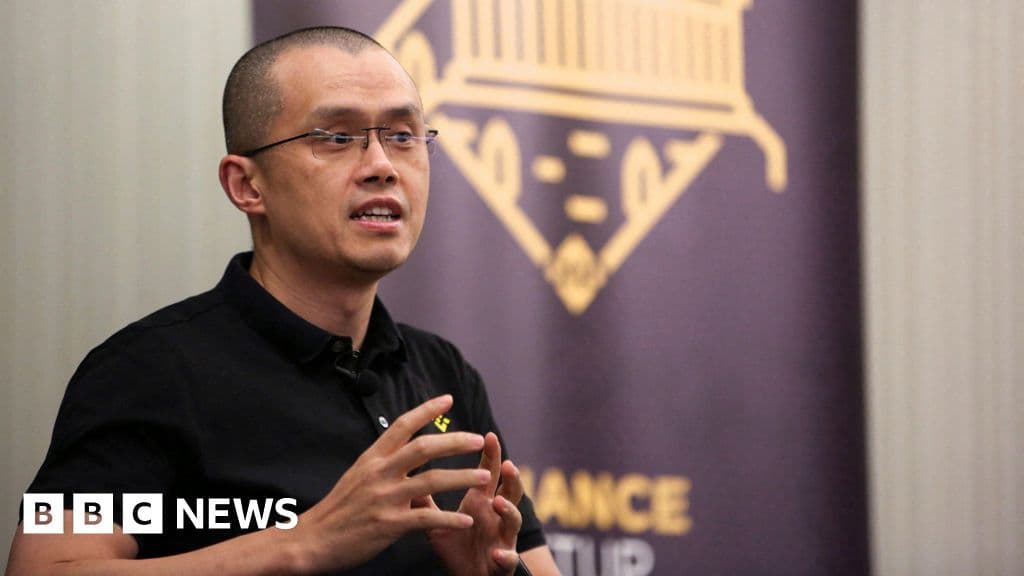

The flickering screens of Times Square, usually ablaze with crypto ticker symbols and promises of untold wealth, seemed to dim for a moment. Then, the news rippled through the financial arteries of the world: Donald J. Trump, in a move that could only be described as audacious, had pardoned Changpeng Zhao, the enigmatic architect of Binance, the world's largest cryptocurrency exchange. The news, breaking like a thunderclap, momentarily silenced the relentless hum of the markets. It was a pardon that transcended mere legal absolution; it was a power play, a strategic masterstroke, and a resounding declaration of a new era in the intersection of politics and finance.

The Lede: A Deal Struck in the Shadows?

The scene, as it unfolded, was less a formal announcement and more a whisper in the echoing halls of power, a hushed conversation over a clandestine phone line. Sources, who spoke on the condition of anonymity – their voices a mix of awe and apprehension – described the chain of events leading up to the pardon. The details, still emerging, paint a picture of intense negotiations, backroom deals, and the silent choreography of political maneuvering. Rumors circulated, fueled by the insatiable appetite of the internet, regarding the role of undisclosed advisors, the flow of 'consulting' fees, and the sheer audacity of the maneuver.

The sheer speed with which the pardon materialized was astonishing. Zhao, once facing potential years behind bars, now walks free, his reputation – at least in the eyes of the law – restored. But this wasn't just about Zhao; it was about Binance, its vast network, and the crypto empire it had built. It was a move that instantly altered the balance of power, forcing regulators, competitors, and the public alike to re-evaluate their positions.

The Context: The Rise and Fall (and Rise Again?) of CZ

To understand the gravity of this moment, one must revisit the saga of Changpeng Zhao, the man known as CZ. From his humble beginnings as a software developer, CZ built Binance into a colossus. His exchange became the go-to platform for millions of traders worldwide, riding the wave of cryptocurrency's explosive growth. Yet, with that success came the scrutiny. Accusations of regulatory violations, money laundering concerns, and operating in jurisdictions without proper licenses dogged Binance for years.

The legal battles were a constant backdrop to Binance's success. The U.S. Securities and Exchange Commission (SEC), the Department of Justice (DOJ), and various international regulators all had their sights set on CZ and his company. He eventually pleaded guilty to violating anti-money laundering regulations, a moment that seemed to signal the beginning of the end for the Binance empire. This was the cliff edge, the precipice from which CZ's future seemed certain to fall.

The weight of the legal pressures and the threat of severe penalties should have been the end of the story. The standard playbook for this scenario involves fines, settlements, and a slow, agonizing slide into obscurity. But the standard playbook, it seems, was not applicable. Trump’s pardon, whether motivated by personal gain, political strategy, or a combination of both, shattered those expectations. It's a move that echoes other moments of audacious reversals of fortune, like when Steve Jobs returned to Apple. It highlights a common thread: the ability of certain figures to defy the established order, fueled by ambition and raw power.

The Core Analysis: Follow the Money, The Strategy, The Psychology

Let's strip away the rhetoric and get to the core. This is about money, power, and strategy. The strategic implications are vast. Trump, with his well-honed instinct for political theater, has inserted himself directly into the heart of the crypto narrative. This is no mere act of mercy; it is a calculated gambit, designed to consolidate support and reshape the financial landscape to his advantage.

First, the money. It's no secret that the cryptocurrency world is awash in capital. Political campaigns are expensive, and Trump is no stranger to seeking deep-pocketed donors. The pardon could unlock a flood of investment, potentially shifting the financial landscape in his favor. It's a well-known fact that the crypto community has often felt alienated by the traditional establishment and has sought political allies.

Second, the strategy. By pardoning CZ, Trump is signaling a pro-crypto stance. He is sending a message that he understands the industry's potential and is willing to support its growth. This resonates with the younger generation, a constituency he's struggling to win over. This also creates a direct contrast with the current administration, which has been less embracing of the digital asset space. This contrast is a key element of his political strategy, playing to the narrative that he's an outsider, fighting the system.

Third, the psychology. This pardon is a masterclass in psychological manipulation. It sends a message to CZ's supporters, investors, and the crypto community that Trump is a powerful ally. It creates a sense of loyalty and obligation. It polarizes the electorate even further, painting the establishment as the enemy. The genius of the play lies in its simplicity; it is an audacious, high-stakes move that is impossible to ignore.

The losers in this scenario are the regulators, the traditional financial institutions, and the critics of cryptocurrency. The regulators face the prospect of a weakened hand, potentially hamstrung in their efforts to rein in the industry. The traditional financial institutions now must reassess their position, as a pro-crypto stance is now politically advantageous. The critics of cryptocurrency, who have long warned of its unregulated nature and potential for abuse, now see their concerns seemingly vindicated. The winners are, without a doubt, CZ, Binance, and, of course, Donald J. Trump.

The consequences for the financial markets are difficult to predict precisely, but some patterns are likely. Expect a surge in crypto prices in the short term, fueled by renewed optimism. Expect increased lobbying efforts by the crypto industry to influence regulations. Expect greater political scrutiny of cryptocurrency and the people who control it. The long-term implications are even more profound. This signals a shift toward a more relaxed regulatory environment, especially if Trump regains the presidency. This is a crucial move that will give CZ an enormous advantage.

The "Macro" View: Reshaping the Industry Landscape

The implications of this pardon extend far beyond the legal and financial realms. It has seismic effects on the global crypto industry. The pardon is a signal to other exchanges, other founders, and other crypto projects that the rules of the game have fundamentally changed. The message is simple: align yourselves with power, and the playing field is yours.

This event could trigger a wave of consolidation in the crypto space. Smaller exchanges, facing increased competition and regulatory pressure, may find themselves acquired by Binance or other entities with stronger political connections. The focus on compliance is expected to shift. The narrative shifts from 'decentralization' to something closer to 'controlled decentralization'. The industry, once known for its libertarian ideals, will now face a future shaped by political influence and the power of connections. The implications for the future of finance are immense.

Furthermore, this pardon has wider implications for the relationship between the government and big business. It confirms the narrative that influence and power matter more than the rule of law. It reinforces the perception that political connections can trump legal consequences. It sends a chilling message to anyone who opposes the established order. This is a moment that should give everyone pause. It demands a serious evaluation of where we are going as a society.

The Verdict: A New Crypto Dawn, or a Dark Age?

So, what happens next? My seasoned prediction, after decades of covering the vagaries of finance and power, is this: The next few years will be a period of intense volatility and regulatory chaos. The crypto market will experience a wild ride, fueled by political machinations and changing fortunes. Binance, under CZ's leadership, is likely to regain its dominance. However, it will also be subject to constant scrutiny, legal challenges, and ethical dilemmas.

The question of regulation remains, hanging heavy in the air. Will this shift create a new paradigm? Will it legitimize crypto, or will it create the conditions for a crisis? The truth, as ever, is complicated. There is no simple answer. The future of crypto will be written not in code, but in the corridors of power and the back rooms of influence. The battle lines are drawn, the players are in place, and the game is just beginning.

The pardon of Changpeng Zhao by Donald Trump will be studied for years to come. It's a landmark event. It will be discussed as a case study in power, finance, and politics. It’s a moment that will forever be etched in the annals of financial history.